Dollar index trading at 98.65 (-0.86%).

Strength meter (today so far) - Aussie +0.44%, Kiwi +0.86%, Loonie +0.96%.

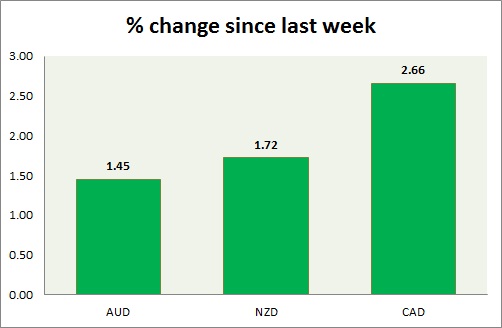

Strength meter (since last week) - Aussie -0.74%, Kiwi -0.09%, Loonie +0.75%.

AUD/USD -

Trading at 0.762

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.771-0.773

Economic release today -

- Australian bank's survey registered improvement. Business confidence rose to 3 from 0 and conditions rose to 6 from 2.

Commentary -

- Aussie is the worst performing currency this week so far, however 0.75 area continue to provide support.

- Pair remains under seller's influence.

- Breaking of Support zone of 0.756-0.75 would give rise to rapid sell offs.

NZD/USD -

Trading at 0.752

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.75-0.753

Economic release today -

- Food price index will be released at 21:45 GMT.

Commentary -

- Kiwi as expected has broken below, the rising trend channel support around 0.75, today's bounce over retail sales present opportunity for sell resistance.

- Bearish doji with long upper shadow remains in focus in weekly chart. Very close to a grave stone doji. Bias remains downwards.

USD/CAD -

Trading at 1.247

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.243-1.24

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28 -1.284, Immediate - 1.267-1.27

Economic release today -

- NIL

Commentary -

- Loonie is the best performer this week among commodity pairs. Pair may be coming down once more to test the support area. Loonie will appreciate faster, should the support around 1.24 gets broken.

- Tomorrow's BOC monetary policy would be a make or break event.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?