Dollar index trading at 95.91 (-0.37%)

Strength meter (today so far) – Aussie +0.55%, Kiwi -0.92%, Loonie +0.28%

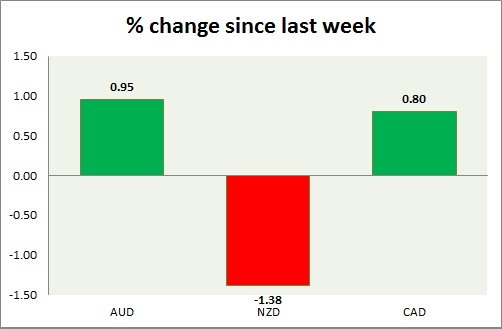

Strength meter (since last week) – Aussie +0.95%, Kiwi -1.38%, Loonie +0.80%

AUD/USD –

Trading at 0.764

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Consumer inflation expectations ticked up to 3.7 percent in July from 3.5 percent in June.

- New motor vehicle sales rose 3.1 percent in June, up 2.1 percent from a year back.

- Unemployment rate rose by 0.1 percent to 5.8 percent as participation rate rose by the same to 64.9 percent. Part time employment declined by 30,500 and permanent employment increased by 38,400.

Commentary –

- Aussie is best performer of the week. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.719

Trend meter –

- Long term – Sell, Medium term – Range, Short term – range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- PMI will be released at 22:45 GMT.

Commentary –

- Kiwi dropped sharply as RBNZ announced a surprise intra-meeting economic assessment.

USD/CAD –

Trading at 1.292

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.32

Economic release today –

- BOC will announce monetary policy decision at 14:00 GMT.

Commentary –

- Loonie is recovering ground riding on weak dollar and higher oil price.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX