Dollar index trading at 97.73 (+0.69%).

Strength meter (today so far) - Aussie +0.70%, Kiwi -0.39%, Loonie -10%.

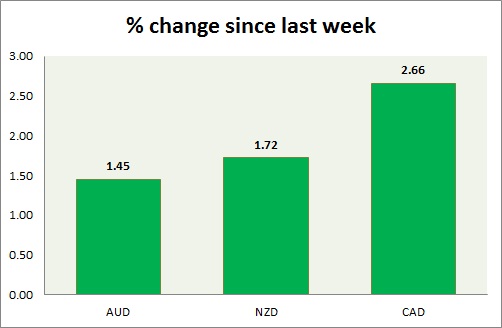

Strength meter (since last week) - Aussie +0.73%, Kiwi -0.74%, Loonie -0.03%.

AUD/USD -

Trading at 0.764

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.766-0.769

Economic release today -

- RBA kept policy rates steady at 2.25%. Retail sales grew 0.7% in March, up from February.

Commentary -

- Aussie posed lackluster bounce back as RBA kept rates on hold. It gained to 0.771 post RBA but failed to maintain gains above.

- Aussie remains capped, in spite of being best performer today.

- Weaker terms of trade is weighing on the currency.

NZD/USD -

Trading at 0.75

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.76-0.763

Economic release today -

- NIL

Commentary -

- As expected pair faced sell offs in resistance zone. A break below trend line might see massive selloffs.

- Very bearish doji with long upper shadow remain in focus in weekly chart. Very close to a grave stone doji. Bias is still downwards.

USD/CAD -

Trading at 1.249

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.247-1.245

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28 -1.284

Economic release today -

- NIL

Commentary -

- Canadian dollar is doing fair comparatively this week. The pair remains range bound facing headwinds from stronger dollar and support from stronger oil price.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary