Dollar index trading at 94.16 (+0.01%)

Strength meter (today so far) – Aussie -0.11%, Kiwi -0.43%, Loonie -0.11%

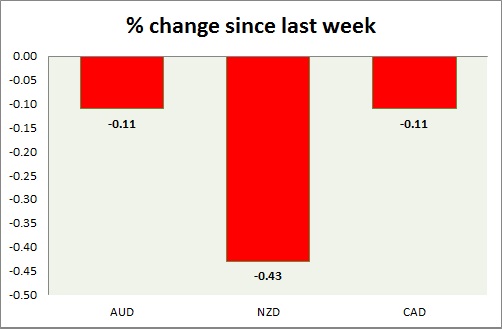

Strength meter (since last week) – Aussie -0.11%, Kiwi -0.43%, Loonie -0.11%

AUD/USD –

Trading at 0.736

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Sell

Support –

- Long term – 0.683, Medium term – 0.7, Short term – 0.7

Resistance –

- Long term – 0.782, Medium term – 0.74, Short term – 0.732

Economic release today –

- TD securities inflation weaken to 1% in May from 1.5% in April.

Commentary –

- Aussie is down over profit bookings. Active call – Sell Aussie against Dollar @0.75 targeting 0.7 area, with stop loss around 0.785

NZD/USD –

Trading at 0.692

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Sell

Support –

- Long term – 0.62, Medium term – 0.63, Short term – 0.656

Resistance –

- Long term – 0.71, Medium term – 0.683, Short term – 0.683

Economic release today –

- NIL

Commentary –

- Kiwi is worst performer today as traders take profit ahead of RBNZ this week. Active call – Sell kiwi against Dollar @0.68 and at rallies with stop loss at 0.725 are and target at 0.61

USD/CAD –

Trading at 1.294

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.248, Medium term – 1.278 , Short term – 1.278

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.32

Economic release today –

- NIL

Commentary –

- Loonie is marginally down heading into Yellen’s speech.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX