Dollar index trading at 95.26 (+0.13%)

Strength meter (today so far) – Aussie -0.34%, Kiwi -0.19%, Loonie -0.57%

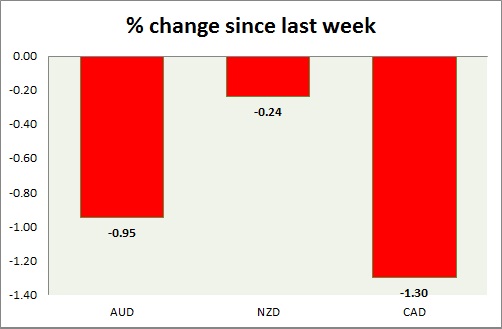

Strength meter (since last week) – Aussie -0.95%, Kiwi -0.24%, Loonie -1.30%

AUD/USD –

Trading at 0.726

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.728, Short term – 0.728

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- Unemployment rate declined to 5.7% on lower participation rate and higher part time employment in tune of 20.2K, whereas permanent job loss was 9.3K.

Commentary –

- Aussie is down sharply after yesterday wages have taken toll. Active call – Sell Aussie against Dollar @0.75 targeting 0.7 area, with stop loss around 0.785

NZD/USD –

Trading at 0.677

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- NIL

Commentary –

- Kiwi is best performer of the week but still that in red.

USD/CAD –

Trading at 1.297

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.3

Economic release today –

- NIL

Commentary –

- Loonie is worst performer of the week as long Dollar takes toll at a time when oil production has been hit severely by wildfire which took as much as 1.8 million barrels/day offline.. Loonie is likely to gain further but more likely to consolidate in near term.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed