Dollar index trading at 93.63 (-0.11%)

Strength meter (today so far) – Aussie -1.47%, Kiwi -0.69%, Loonie -0.27%

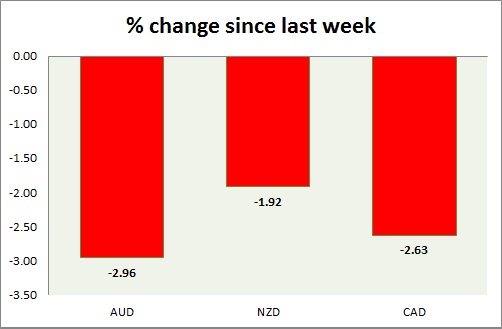

Strength meter (since last week) – Aussie -2.96%, Kiwi -1.92%, Loonie -2.63%

AUD/USD –

Trading at 0.737

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.728, Short term – 0.742

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- RBA released its detailed monetary policy assessment

Commentary –

- Aussie suffered big drop today as RBA cuts its inflation forecast and showed openness to aggressive stimulus. Active call – Sell Aussie against Dollar @0.75 targeting 0.7 area, with stop loss around 0.785

NZD/USD –

Trading at 0.684

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- NIL

Commentary –

- Kiwi is down again today but remains best performer of the week.

USD/CAD –

Trading at 1.289

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.3

Economic release today –

- Unemployment report will be released at 12:30 GMT.

Commentary –

- Loonie is down more than 2.5% this week on weaker oil, higher trade deficit and dovish Poloz. All targets reached except 1.17 area, which may take a while and correction higher for the pair.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022