Dollar index trading at 93.18 (-0.66%)

Strength meter (today so far) – Aussie -0.28%, Kiwi +0.17%, Loonie +0.23%

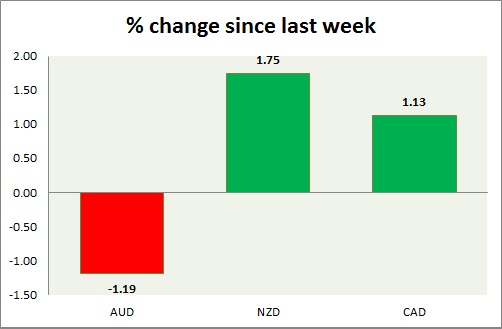

Strength meter (since last week) – Aussie -1.19%, Kiwi +1.75%, Loonie +1.13%

AUD/USD –

Trading at 0.761

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.728, Short term – 0.742

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- Australia’s terms of trade deteriorated as import prices dropped -3% in first quarter while export prices dropped -4.7%

Commentary –

- Aussie failed to gain on weaker Dollar and higher iron ore prices. Lower CPI is still weighing in. Moreover, China’s attempt to curb speculation over Iron ore souring the mood.

NZD/USD –

Trading at 0.697

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- RBNZ Kept monetary policy unchanged at 2.25%.

Commentary –

- Kiwi is the best performer this week as RBNZ kept rates on hold this week.

USD/CAD –

Trading at 1.252

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.3

Economic release today –

- NIL

Commentary –

- Loonie is testing key resistance around 1.25 area. All targets reached except 1.17 area, which may take a while and correction higher for the pair.