Dollar index trading at 98.30 (+0.17%)

Strength meter (today so far) - Aussie +0.32%, Kiwi -0.66%, Loonie -0.38%

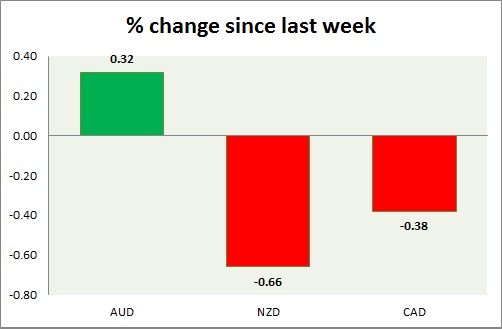

Strength meter (since last week) - Aussie +0.32%, Kiwi -0.66%, Loonie -0.38%

AUD/USD -

Trading at 0.714

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range

Support -

- Long term - 0.63, Medium term - 0.68, Short term - 0.703

Resistance -

- Long term - 0.75, Medium term - 0.738, Short term - 0.733

Economic release today -

- TD securities inflation down -0.2% in February, up 2.1% from a year ago.

- Private sector credit rose 0.5% in January, up 6.5% from a year ago.

- Company gross operating profits declined by -2.8% in fourth quarter of 2015.

- AIG performance of manufacturing index will be released at 22:30 GMT.

Commentary -

- Aussie is best performer today.

NZD/USD -

Trading at 0.658

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support -

- Long term - 0.56, Medium term - 0.62, Short term - 0.643

Resistance -

- Long term - 0.7, Medium term - 0.69, Short term - 0.69

Economic release today -

- Terms of trade will be released at 21:45 GMT.

Commentary -

- Kiwi is worst performer today as risk aversion rises.

USD/CAD -

Trading at 1.356

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.285, Medium term - 1.34, Short term - 1.35

Resistance -

- Long term - 1.5, Medium term - 1.45, Short term - 1.42

Economic release today -

- Raw material price index for January will be released at 13:30 GMT, along with industrial product price.

Commentary -

- Canadian Dollar is down due to weakness in oil price.