Dollar index trading at 96.70 (-0.08%)

Strength meter (today so far) – Aussie -0.20%, Kiwi -0.23%, Loonie +0.76%

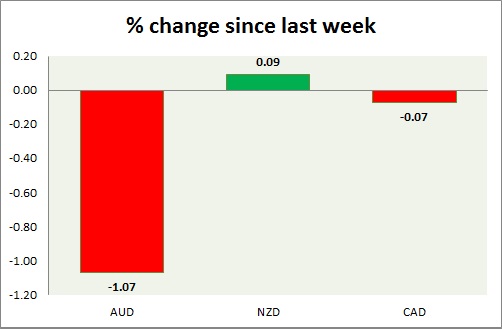

Strength meter (since last week) – Aussie -1.07%, Kiwi +0.09%, Loonie -0.07%

AUD/USD –

Trading at 0.722

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/buy

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732

Economic release today –

- Trade balance came at $2.32 billion in October, with exports rising by 1 percent, and imports rising by 3 percent.

Commentary –

- The Australian dollar is declining sharply after a failure to break the key resistance around 0.733 area and as the USD recovered. Weaker than expected Q3 GDP is also weighing on the Aussie.

NZD/USD -

Trading at 0.687

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.695 (testing)

Economic release today –

- NIL

Commentary –

- The New Zealand dollar is the best performer of the week as a stronger economy weighs over stronger USD. However, moving lower amid a stronger USD. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.329

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.315

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.33 (broken)

Economic release today –

- The unemployment rate declined to 5.6 percent in November, despite a 0.2 percent increase in the participation rate.

Commentary –

- Loonie recovered on the back of a weaker USD but lower oil price weigh. Canada’s benchmark crude oil trading at just $28.8 per barrel. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX