Dollar index trading at 94.45 (+0.58%)

Strength meter (today so far) - Aussie -0.02%, Kiwi +0.82%, Loonie +0.20%.

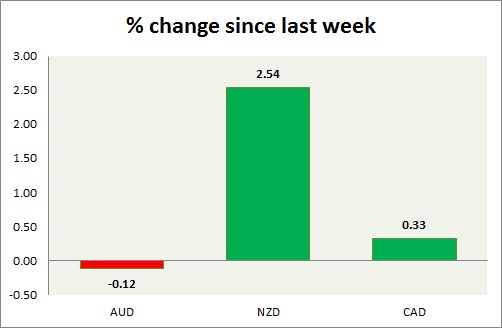

Strength meter (since last week) - Aussie -0.12%, Kiwi +2.54%, Loonie +0.33%.

AUD/USD -

Trading at 0.732

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685, immediate - 0.695

Resistance -

- Long term - 0.83, Medium term - 0.785, Short term - 0.745

Economic release today -

- Consumer inflation expectations rose to 3.5% in October from 3.2% in September.

- Employment dropped by -5100 in September, while unemployment rate remained same as prior at 6.2%.

- New motor vehicle sales rose by 5.5% in September, up 7.7% from a year ago.

Commentary -

- Aussie is the worst performing commodity currency this week so far. Active call - Sell Aussie @ 0.76 with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.687

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Buy

Support -

- Long term - 0.56, Medium term - 0.625, Short term - 0.66

Resistance -

- Long term - 0.72, Medium term - 0.68 (broken), Short term - 0.68 (broken)

Economic release today -

- Consumer price index for third quarter to be released at 21:45 GMT.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. However in the short term it might rise further. Kiwi is the best performer this week so far.

USD/CAD -

Trading at 1.289

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29 (broken)

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.35

Economic release today -

- NIL

Commentary -

- Loonie has broken below key support of 1.29 against Dollar and might drop further towards 1.21. Active call - Sell USD/CAD @ 1.288 with target around 1.265, 1.24, 1.215 and 1.20

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings