Dollar index trading at 95.45 (-0.12%)

Strength meter (today so far) - Aussie +0.01%, Kiwi +0.01%, Loonie +0.06%.

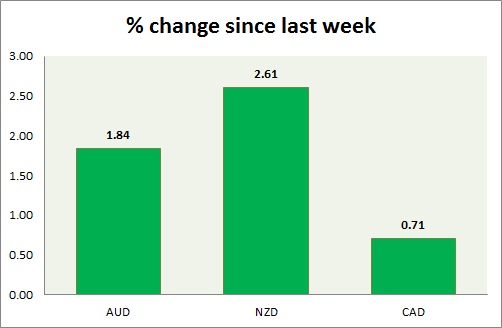

Strength meter (since last week) - Aussie +1.84%, Kiwi +2.61%, Loonie +0.71%.

AUD/USD -

Trading at 0.719

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685, immediate - 0.695

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.725

Economic release today -

- NIL

Commentary -

- Aussie rally is taking breather ahead of FOMC minutes. Active call - Sell Aussie @ 0.76 with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.66

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.652 (broken)

Economic release today -

- Housing starts rose to 230.7K in September, up from 214.3K in August.

- New house price index rose 0.3% in September.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi is best performer this week as higher milk price is providing support.

USD/CAD -

Trading at 1.306

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29,

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.35

Economic release today -

- Electronic card retail sales to be released at 21:45 GMT.

Commentary -

- Loonie is up this week in line with broad based strength in commodity currencies but still the worst performer among the lot. Pair is struggling close to 1.3 psychological support.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate