Bitcoin’s price (BTCUSD) has been drifting in sideways after two day’s corrections (i.e. more than -3%), while the overbought sentiment pauses BTCUSD rallies above $8,630 levels despite vigorous price slumps from the last two days.

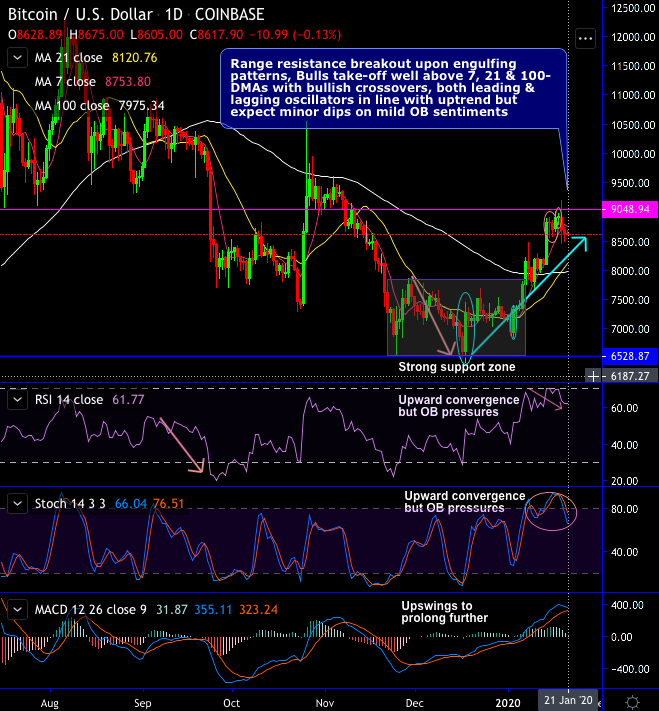

Technically, the range resistance has been broken out upon the bullish engulfing patterns, Consequently, bulls have taken-off well above 7, 21 & 100-DMAs with bullish crossovers (1st chart for daily plotting).

Shooting star followed by hanging man patterns plummet prices below EMAs, hammer and dragonfly doji counters with sharp rallies, the major trend jumps above 21-EMAs (refer 2nd chart for weekly plotting).

While both leading and lagging oscillators are in line with the prevailing uptrend but expect minor dips on the mild overbought sentiments.

Amid such a bullish travel, the pair has bounced from the lows of $6,430 to the recent peaks of $9,194.84 levels with rising volumes and open interest (OI) for CME bitcoin futures (refer 3rd chart).

To infer positioning in bitcoin futures, we use open interest position proxy methodology advocated by JPM that we also apply to other futures contracts as well, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week.

The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa.

When there is a price decrease, the net long position of spec investors decreases also with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest).

As we could foresee further upside price risks, we have already advocated long hedges a fortnight ago so as to move in sync with the trend, now they must have not only arrested upside risks but also derived leveraged yields on trading grounds, we wish to uphold the same strategy on hedging grounds. Courtesy: JPM

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data