There are a plethora of options in cryptocurrency derivatives marketplace as the digital assets as evolving gradually, the new start-ups like ICE’s Bakkt, BitMEX, LedgerX, Grayscale, OKEx, Deribit, and bitFlyer are lined up with their new derivatives products for crypto-assets to target their market share.

Amid a competition in the evolving industry, the Chicago Mercantile Exchange (CME) Group maintained their dominance by recording considerable volumes in 2019 for its bitcoin futures trading which are cash-settled, screening renewed interest in this avenue.

Well, we’ve already reported Bitcoin’s new volume persuaded the futures market, CME bitcoin futures trading observes massive growth of 63.5k contracts traded in the recent past.

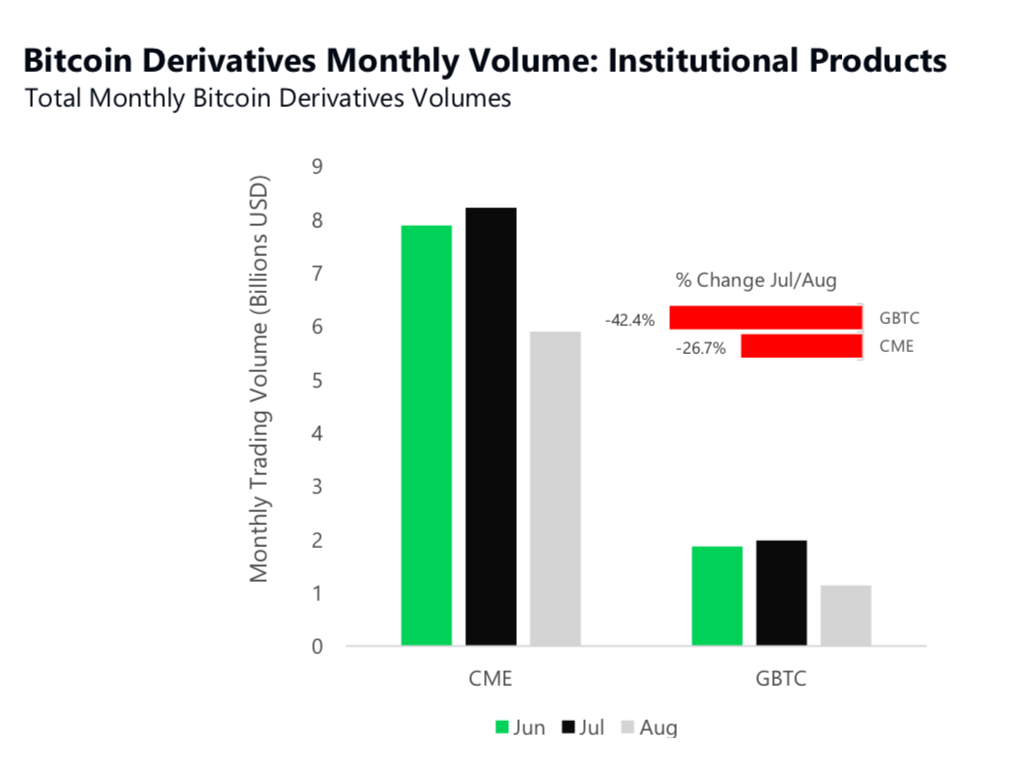

As per a report for the month of August by the cryptocurrency data providing company, ‘CryptoCompare’, Chicago Mercantile Exchange (CME) has been dominating in the gamut of derivatives, the regulated Bitcoin derivatives product for the CME in August was $5.9 billion. The exchange has been leading the space despite witnessing a 26.7% decrease since July.

As you could refer to their report, the regulated bitcoin derivatives product volumes are also highest by CME, whose total trading volumes are down 26.7% since July at 5.9 billion USD.

CME’s bitcoin futures product volumes decreased from a total of 8.06 billion USD traded in July to a total of 5.9 billion USD traded in August. Meanwhile, Grayscale’s bitcoin trust product (GBTC), decreased in terms of total trading volume with 1.14 billion USD traded in August (down 42.4% since July).

A probable cause of this drop was the close of a major round of CME Bitcoin futures contracts. Over 50% of CME Bitcoin futures open interest expired last week. It’s likely that most of this money flowed out of Bitcoin futures and into other derivative markets.

Daily volumes for BTC on the CME have been steadily falling over the last two months and institutional traders may be looking at other asset markets for new profit opportunities.

The prices of CME BTC futures contracts are cash-settled and would be subject to the CME CF Bitcoin Reference Rate (BRR) for the financial benchmarks.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge