Bitcoin’s price (BTCUSD) has been continuing further its two day’s rallies (i.e. shy above 9%), while the overbought sentiment paused BTCUSD rallies above $9k levels.

As we noted a few weeks ago, the CME launched bitcoin options contracts based on the underlying CME cash- settled futures contracts. While this was not the first bitcoin option contract, as there are already option contracts actively traded at Derebit and LedgerX as well as the ICE/Bakkt options contracts that settle into the underlying physically-delivered monthly futures contract launched on Dec 9th, this launch had been widely anticipated given the dominance of CME in trading bitcoin futures in regulated exchanges.

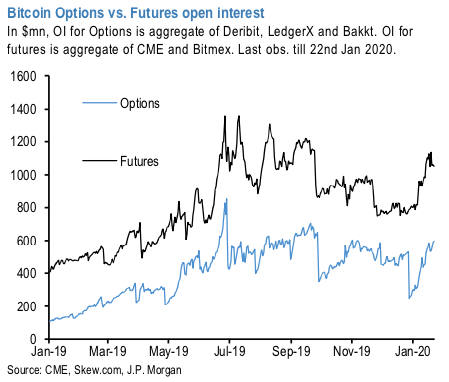

Since the CME’s bitcoin options contracts were launched on Jan 13th, the open interest has risen to above $10mn according to data from skew.com, well above the peak thus far of the previously listed ICE/Bakkt options just over $1mn.

This still remains well below the around $540mn of open interest on Derebit/LedgerX, which form the bulk of the total open interest in Bitcoin options (refer above chart), but the average daily volumes of the CME options since launch at around $1.1mn compares well with the average daily volumes on LedgerX over the same period of $0.4mn.

Moreover, while there is a gap between the open interest between offshore unregulated venues and the CME for futures, a substantial part of this difference is likely due to leverage. The minimum initial margin on offshore unregulated venues is typically around 1%, compared to the CME’s initial margin of 37%.

For options, by contrast, there is less reason to expect such a divergence to persist, as margins are not used in the same way to gain leverage as for futures. Also, some hedge funds who do not necessarily have a fundamental view on bitcoin direction could see opportunities in trading volatility. The CME’s reputation and credibility in US derivatives markets more broadly could be a substantial advantage in attracting those potential market participants. Courtesy: JPM

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data