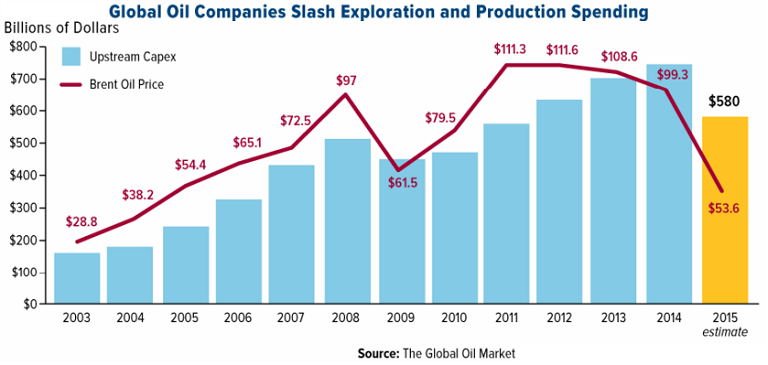

According to a survey by the ratings agency Standard & Poor’s released on Thursday, global capital expenditure by companies across all sectors fell 10% in 2015, major drag being on account of oil and gas companies which cut their capex by nearly a quarter (24%) in 2015. S&P says the severe Commodity-Related cuts are likely to extend, with a further 15% reduction in oil and gas companies capex slated for 2016. S&P projects Global Capex to shrink by a further 4% in 2016 and 2% in 2017.

Although major oil companies such as Chevron in the US insist that, capex will see huge growth in the long-term on increased oil demand, an erratic crude price is currently forcing the industry to rip up spending plans and conserve cash. The price of Brent crude has rebounded in recent weeks but is well over 20% below its level from 12 months ago. In February, oil tumbled to a level last seen in 2003.

"Our pessimism regarding the corporate capex outlook is founded on the weak prospects for commodity-related capital investment but, even so, the scale of recent cutbacks has been remarkable," said Gareth Williams, Senior Director, Corporate Research, Standard & Poor's Ratings Services.

Excluding commodity producers, the S&P argues the capex picture is a brighter one. S&P said capex excluding energy and materials is likely to return to positive growth this year. Momentum is likely to come from information technology, consumer discretionary as well as health care industries which are likely to step up investment. However concerns about the fragile global economy and doubts regarding the ability of central banks to trigger investment remain.

"In addition to the slump in commodity capex, global overcapacity remains a problem for industries such as steel and shipping. More broadly, poor revenue and EBITDA trends explain much of the paucity of capex growth," notes Gareth Williams.

S&P noted that capex forecasts are down for all regions except Japan. Japan has less commodity exposure and is expected to see growth in 2016. Latin America's significant exposure to weakness in commodities and China's moderating rate of economic growth make it most vulnerable. The region suffered a particularly severe slump, because of its substantial exposure to basic materials, metal and mining.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?