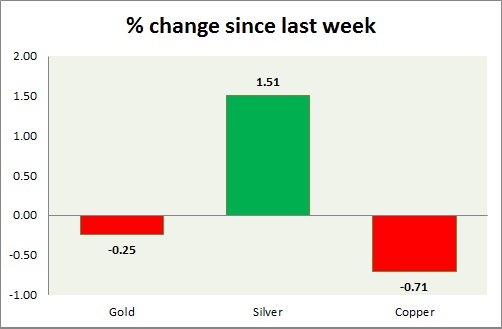

Metals are trading in green post-employment cost data. Performance this week at a glance in chart & table -

Gold -

- Gold jumped back but was rejected at $1100 mark again and finding bids around $1080 mark. Today's range - $1103-$1080.

- Gold is likely to trade with downside bias, however a sustained push below $1050 is unlikely

- Gold is currently trading at $1096/troy ounce. Immediate support lies at $1060 and resistance at $1120 area.

Silver -

- Silver is better performer than gold this week, however was rejected at $15 resistance area once again today. Today's range $15-14.55

- Silver is currently trading at $14.84/troy ounce. Support lies at $14 & resistance at $16. $15 is likely to pose interim resistance, whereas $14.5 remains interim support.

Copper -

- Copper is treading water around $2.35 area. Today's range $2.42-2.35.

- Next target is around $2.24.

- Copper is currently trading at $2.37/pound, immediate support lies at, $2.2 & resistance at $2.65.

|

Gold |

-0.25% |

|

Silver |

+1.51% |

|

Copper |

-0.71% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate