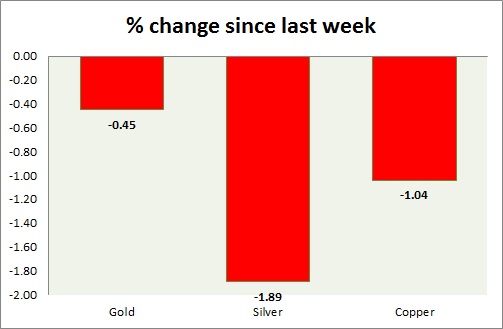

Metals gave up some of the gains after stronger data was published last night namely durable goods order and CPI but this morning again trying to gain back the ground lost. Performance this week at a glance in chart & table -

- Gold - Gold bulls fought back well after last night's strong data and trying to secure a positive weekly close after fall of consecutive four week. Risk reward ratio remains favorable to enter long position at this stage. Gold is currently trading at $1215/ troy ounce. Immediate support lies at 1190 & resistance at 1224.

- Silver - Silver remained flat for today's trading made a high of 16.7 and low at 16.4. Gold silver ratio is hovering near decade highs at 73. Support lies at 15.5 & resistance at 17.6.

- Copper - Copper is still the best performer of the week. This week based on demand from china copper has broken above 5 week high. The metal is expected to continue the strong run in the short term. The copper is trading at $ 2.68/pound. Immediate support lies at 2.62 & resistance at 2.72. Once the level is broken copper may reach as high as $ 2.84/pound.

|

Gold |

0.58% |

|

Silver |

2.09% |

|

Copper |

3.12% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary