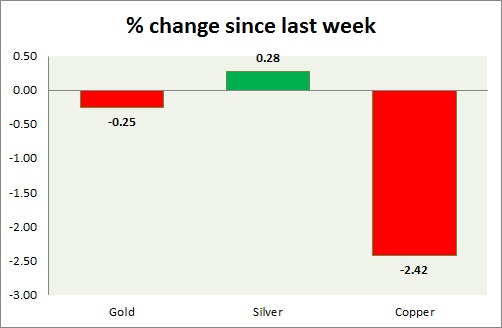

Precious metals are treading water, while industrial remains weak. Performance this week at a glance in chart & table -

Gold -

- Gold is treading water ahead of FOMC monetary policy tomorrow. Today's range - $1188 - $1175

- Gold might reach $1152 area, since $1178 support got broken. Stop is around $1200.

- Gold is currently trading at $1178/troy ounce. Immediate support lies at $1152 and resistance at $1224, $1236-1240 area.

Silver -

- Silver is hovering around $16 as FOMC approaches.

- Mint ratio is up by 0.2% today, currently at 73.8. Mint ratio and precious metal prices are inversely related more often than not.

- FED is make or break event for silver as it tests key support.

- Silver is currently trading at $16/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- As expected, copper is moving down, traded as low as $2.615/pound.

- Next target is around $2.52/ pound since support at $2.65 got broken. However since target stands close, partial profit booking can be done prior to FOMC.

- Copper is currently trading at $2.62/pound, immediate support lies at $2.5 & resistance at $2.75, $2.84, $2.89, $2.95.

|

Gold |

-0.25% |

|

Silver |

+0.28% |

|

Copper |

-2.42% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?