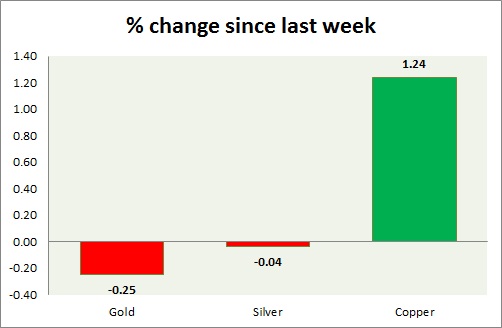

Metals' performance are mixed in today's trading, sellers broadly remain at large. Performance this week at a glance in chart & table -

Gold -

- Gold is lacking direction bias, drifting around $1200, taking cues from dollar. However, since last week gold has performed relatively well among currencies and metals.

- Prices might come back to test support areas at $1174 and $1147, should it fail to maintain above $1208.

- Gold is currently trading at $1197, down 0.7% today. Immediate support lies at $1193, $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver was the worst performer last week, and down today once again. Volatility remains large since last week. Bears might push prices further down. $16 providing interim support.

- Mint ratio flat today, currently at 73.3. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.34/troy ounce, down 0.4% today. Downtrend remains intact and price might plunge lower. Support lies at 15.42,14 & resistance at 17.5-17.7.

Copper -

- Copper continuing its range of $2.71-$2.78. Weak Chinese data failed to impact much.

- Bears are in full control around $2.8-2.92 area. Downside target is coming around $2.52, with a stop of $2.84.

- Bearish inverted hammer remains in play in weekly chart. Moreover last week price pattern produced another bearish doji. More encouraging for the bears.

- Copper is currently trading at $2.73/pound. Immediate support lies at 2.59 & resistance at 2.83, 2.93, and 3.07.

|

Gold |

-0.66% |

|

Silver |

-0.41% |

|

Copper |

0.11% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand