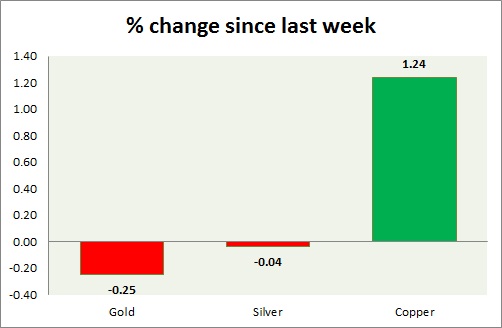

Metals as a pack doing worse this week even before FOMC. Performance this week at a glance in chart & table -

- Gold - Gold is trading below $1150, even before FOMC and testing the support intraday. A break below over FOMC might take gold as low as $1040/ troy ounce. Gold is currently trading at $1148/ troy ounce. Immediate support lies at 1144, 1132, 1040 & resistance at 1166, 1175, 1192.

- Silver - Silver is the best performer this week. FOMC might provide further direction. Mint ratio is at 74, up 0.15% today. Prices might reach as low as $14/troy ounce as key level remains broken. Silver is currently trading at $15.5/troy ounce. Support lies at 14 & resistance at 16.6.

- Copper - Copper is the worst performer this week. Copper is heavy over slowdown in China. Today's weaker house price data poured water over bulls. Copper is currently trading at $2.57/pound. Price pattern suggests loss towards 2.47 levels should the resistance at $ 2.72 holds. Immediate support lies at 2.52 & resistance at 2.64.

|

Gold |

-0.78% |

|

Silver |

-0.69% |

|

Copper |

-3.82% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand