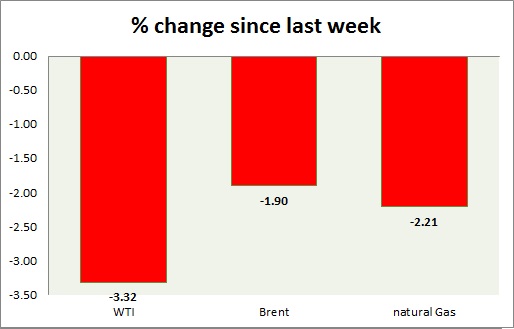

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Saudi Arabia is set to reduce exports to Asia and as inventories decline. In June Saudi exports of oil declined to lowest in three years. However, increased production from OPEC is exerting downside pressure on oil Today’s range $47.4 -46.9

- Active call – Buy targeting $56 per barrel

- WTI is currently trading at $47.2/barrel. Immediate support lies at $45 area and resistance at $52 area.

Oil (Brent) –

- Brent is a much better performer than WTI this week. Today’s range - $50.8-51.4

- Brent is trading at $3.9 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $51.1/barrel. Immediate support lies at $48 area and resistance at $54 region.

Natural Gas –

- Natural gas is moving down after testing key downtrend line around $3 area. Today’s range $2.88-2.93

- Active Call -Bear trend would push it towards $2.52 per MMBtu

- Natural Gas is currently trading at $2.91/MMBtu. Immediate support lies at $2.87 area & resistance at and $3.02

|

WTI |

-3.32% |

|

Brent |

-1.90% |

|

Natural Gas |

-2.21% |

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022