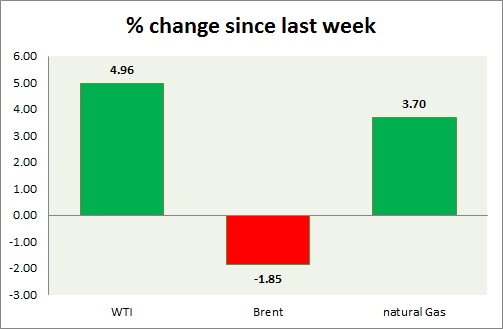

Energy segment still continue to suffer over supply side issues and comments. Performance this week at a glance in chart & table -

- Oil (WTI) - WTI is failing to gain above $50 as supply glut continue to weigh on price. After inventory data published showed stock piling increased by further 10.3 million barrels WTI slipped by further 70 cents and giving the gains made above 50. The price actions suggest that market might be getting fatigued over the concern of supply side and may continue sideways for now. WTI is currently trading at $49.8/ barrel, up 0.40%. Immediate support lies at 48 and resistance at 54.

- Oil (Brent) - Brent is the worst performer today and this week so far it lost some of the gains on spreads as Saudi oil minister confirmed the country's position over production cuts as no go. Brent-WTI spread narrowed further and trading just below $10. Brent is trading at $59.7/barrel, up 1.8%. Immediate support lies at 58 & resistance at 63.

- Natural Gas - Natural gas has taken support from the level and trying to stage a relief over the bitter cold in US. The price is currently trading at $2.75/mmbtu. Immediate support lies at 2.65, 2.56 & resistance at 2.82. Prices could decline over the summer and once the support at $2.55 breaks down it could move even below $2/mmbtu.

|

WTI |

1.30% |

|

Brent |

-3.99% |

|

Natural Gas |

1.85% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings