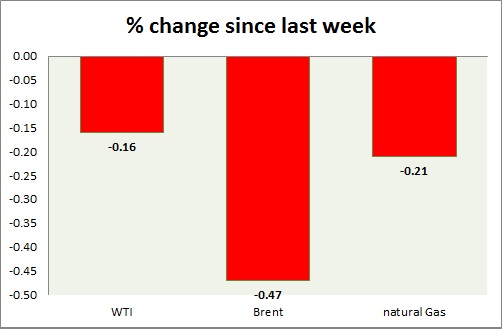

Energy pack is in consolidation today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is continuing its testing of key level at $50/barrel. Today's range $51.4-50

- WTI is likely to fall towards $42 area, once $50 support gets broken.

- WTI is currently trading at $50.7/barrel. Immediate support lies at $50 and resistance at $54

Oil (Brent) -

- Brent is continue trading water as Iran sanctions removal still remains elusive.

- Brent-WTI spread dropped by 20 cents today, currently trading at $6.1/barrel.

- Next target is around $51/barrel if support around $55/barrel gets cleared.

- Brent is trading at $56.8/barrel. Immediate support lies at $55 area and resistance at $59/60 region.

Natural Gas -

- Natural gas bulls are gaining today as dollar weakened today. Today's range $2.82-2.89.

- A break above $2.95 area would push prices to first target of $3.1/mmbtu. However a failure would push prices lower.

- Bullish Doji, in weekly chart remains in focus. However resistance at $2.95 is quite strong.

- Natural Gas is currently trading at $2.87/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.95, $3.04, $3.32.

|

WTI |

-0.16% |

|

Brent |

-0.47% |

|

Natural Gas |

-0.21% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand