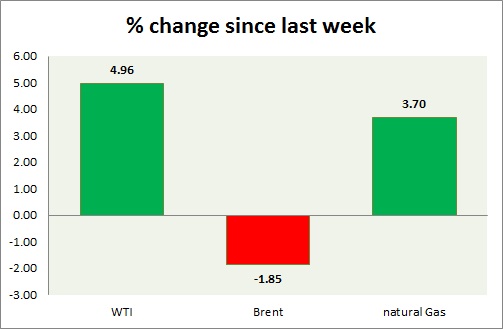

The energy segment remains the worst performer of the week as an asset class. Performance this week at a glance in chart & table -

- Oil (WTI) - Crude oil continue to tread water as mixed news continue over the week. To major rumor spreading in the markets are that the super glut in the US to continue further and the oil companies are cutting down the rigs much faster than anticipated. None of them have played out much so far in the price. WTI is currently trading at $48.9/ barrel, up 1.5% for the day. Immediate support lies at 48 and resistance at 54.

- Oil (Brent) - Brent remained the top performer as demand outlook improved. Brent-WTI spread has broken above $12 and currently trading close to $12.2. Further gain seems to be ahead. Brent is currently trading at $61.2/barrel, up 1.08% for the day. Immediate support lies at 58 & resistance at 63.

- Natural Gas - Natural gas is the worst performer and worsened further after yesterday's inventory release that showed a lesser outflow. In today's trading it is trying to gain some lost ground. Caution for the bears, east coast is still facing some record cold which might stop the price to deteriorate rapidly. Natural gas is currently trading at $ 2.73/mmbtu, up 1.5% for the day. Immediate support lies at 2.66 & resistance at 2.88. Prices could decline over the summer and even below $2/mmbtu.

|

WTI |

-3.74% |

|

Brent |

1.78% |

|

Natural Gas |

-7.52% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand