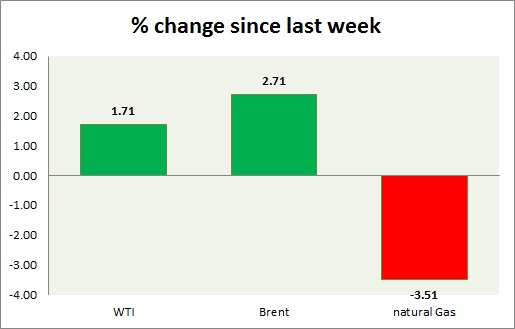

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI continuing its consolidation this week as it faces support from OPEC deal and resistance from higher production from United States, higher inventories, and a stronger dollar. Cash market tightening suggests that the OPEC deal might be working. The oil price seems to have energized finally as hedge funds push positions to record high. Today’s range $53.5-54.9

- With an OPEC and non-OPEC deal done, the oil price is likely to reach $59 and $68 per barrel. However, WTI might decline to $46 per barrel in the short term.

- WTI is currently trading at $54.7/barrel. Immediate support lies at $49 area and resistance at $57 area.

Oil (Brent) –

- Brent is much worse performer than WTI this week. Today’s range - $57.3-56.1

- Brent is trading at $2.5 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $57.2/barrel. Immediate support lies at $52 area and resistance at $58 region.

Natural Gas –

- Natural gas is close to our target of $2.7. Target extended to $2.5 per MMBtu. Today’s range $2.78-2.75

- Natural Gas is currently trading at $2.75/mmbtu. Immediate support lies at $2.6 area & resistance at $2.9 and $3.1

|

WTI |

+1.71% |

|

Brent |

+2.71% |

|

Natural Gas |

-3.51% |

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX