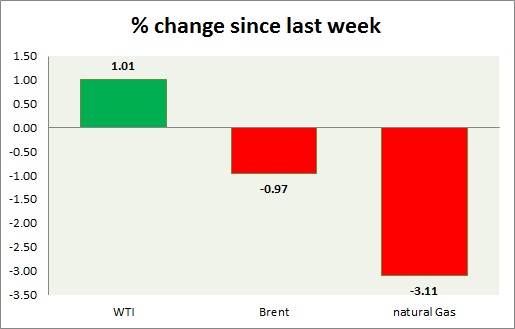

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI is struggling as the production in the United States rising faster than expected. However, looking to close the week in positive. Today’s range $51.4-53

- With an OPEC and non-OPEC deal done, the oil price is likely to reach $59 and $68 per barrel. However, WTI might decline to $46 per barrel in the short term.

- WTI is currently trading at $52.9/barrel. Immediate support lies at $49 area and resistance at $57 area.

Oil (Brent) –

- Brent is much worse performer than the WTI. Today’s range - $54.1-55.1

- Brent is trading at $2.1 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $55/barrel. Immediate support lies at $52 area and resistance at $58 region.

Natural Gas –

- Facing large inventory, Natural gas is suffering heavy selling pressure; supply/demand fundamentals are in for rally but inventories are still too high. Last week inventory declined by large 243 billion cubic but that might ultimately prove insufficient Sell Natural gas targeting $2.7 per MMBtu. Today’s range $3.33-3.26

- Natural Gas is currently trading at $3.3/mmbtu. Immediate support lies at $2.6, $3.1 area & resistance at $3.5 and $3.75

|

WTI |

+1.01% |

|

Brent |

-0.97% |

|

Natural Gas |

-3.11% |

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed