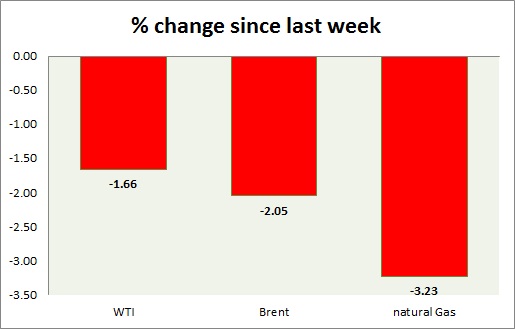

Energy pack is down in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI is as the production in the United States rise faster than expected. Today’s range $51.8-51.2

- With an OPEC and non-OPEC deal done, the oil price is likely to reach $59 and $68 per barrel. However, WTI might decline to $46 per barrel in the short term.

- WTI is currently trading at $51.5/barrel. Immediate support lies at $49 area and resistance at $57 area.

Oil (Brent) –

- Brent is up in line with the WTI. Today’s range - $54.1-54.8

- Brent is trading at $2.9 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $54.4/barrel. Immediate support lies at $52 area and resistance at $58 region.

Natural Gas –

- Facing large inventory, Natural gas is suffering heavy selling pressure; supply/demand fundamentals are in for rally but inventories are still too high. Sell Natural gas targeting $2.7 per MMBtu. Today’s range $3.35-3.29

- Natural Gas is currently trading at $3.3/mmbtu. Immediate support lies at $2.6, $3.1 area & resistance at $3.5 and $3.75

|

WTI |

-1.66% |

|

Brent |

-2.05% |

|

Natural Gas |

-3.23% |

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX