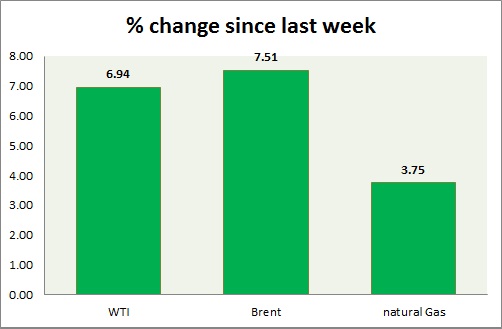

Energy segment is the best performer this week, breaking important resistance. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI has broken above three month high which in itself sign of strong buying interest.

- Bulls might once again move to test $54-54.5 area. Breakout of the area would push prices higher towards $60 as initial target area. $63-65 area comes next. Expect higher volatilities.

- WTI is currently trading at $55.3/barrel, down -1.8% today. Bulls were rejected at $56.5 area. Immediate support lies at $51.2-50, $47.5-47 and resistance at $54-54.5, and $58.9-59.7.

Oil (Brent) -

- Brent is the best performer this week, taken out resistance around $60. Further appreciation likely. However resistance area remains close.

- Brent-WTI spread widened over late night trading, currently trading at $7/barrel. However as of now, Brent is much closer to Resistance area than WTI, which might squeeze spread.

- Brent is trading at $62.3/barrel. Immediate support lies at $58-57 area and resistance at $ 62.6-64 region.

Natural Gas -

- Natural gas bounce back gathered further pace today, after price traded close to initial target area of $2.44/mmbtu. Broader downtrend remains intact, despite bounce back.

- Natural Gas is currently trading at 2.60/mmbtu. Immediate support lies at $2.12 area & resistance at $2.60, 2.66, 2.71.

|

WTI |

+6.94% |

|

Brent |

+7.51% |

|

Natural Gas |

+3.75% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary