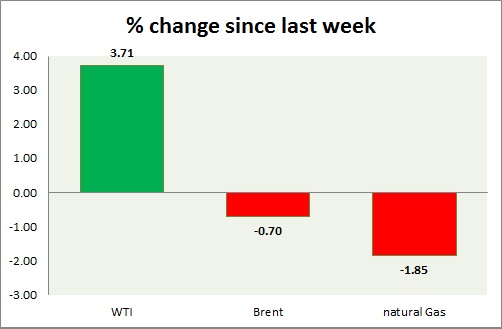

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI is down over risk aversion today and likely to move higher but unlikely to cross $42-45 area in this run. Our first target reached. Today’s range $41.8-40.7

- WTI is currently trading at $40.8/barrel. Immediate support lies at $32.8, 36.5 area and resistance at $43.5, 49 area.

Oil (Brent) –

- Brent is relatively better performer than WTI. Brent is likely to be stronger than WTI over next one month. Today’s range - $41.8-40.9

- Brent is at $ 0.3/barrel premium to WTI.

- Brent is trading at $41.1/barrel. Immediate support lies at $38.5, $35.4 area and resistance at $47, $52 region.

Natural Gas –

- Natural gas is best performer today. Today’s range $1.79 -1.87

- Active call – sell natural gas targeting $1.32 and $1.2 area with stop around $2.3

- Natural Gas is currently trading at $1.86/mmbtu. Immediate support lies at $1.75 area & resistance at $2 and $2.3

|

WTI |

+3.71% |

|

Brent |

-0.70% |

|

Natural Gas |

-1.85% |

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX