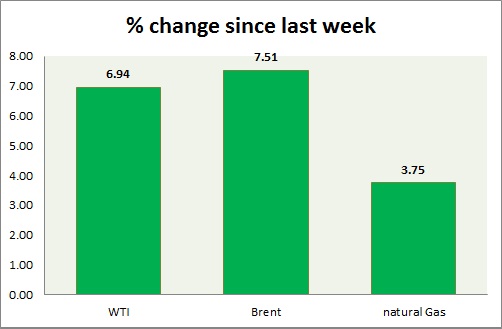

Today is all about Saudi air strike in energy market that led to short squeeze. Weekly performance at a glance in chart & table

- Oil (WTI) - WTI just got a boost from air strikes by Saudi Arabia on Yemen rebels. Direct military involvement by OPEC's largest producer is always full of tension. So WTI soared more than 5% today. Traded as high as 52.47. Price has reached 1st target of $51/barrel and might move towards next at $54/barrel. However fundamental selling pressure would be large in this region and price might suffer if Saudi situation subsides. Immediate support lies at 47.5-47, 44-43.7 and resistance at 54-54.5, 58.7-59.2.

- Oil (Brent) - Brent held gains better than WTI, however minor improvement over spread puts doubt over overall recovery in price. Brent-WTI spread tightened, trading at $ 8.2/barrel, might go further down if situation subsides. Last week it traded close to $11.5/barrel. Brent is trading at $58.7/barrel, up 4% today. Immediate support lies at 56.7-56.3, 53 & resistance at 62.6-63.4.

- Natural Gas - Natural gas is the worst performer today and this week, still trading within its range. However price pattern suggests that prices might drop down towards $2.44/mmbtu. Approaching summer is weighing on price. Natural Gas is currently trading at 2.65/mmbtu, down -2.4% today. Immediate support lies at 2.65, 2.55 & resistance at 2.91, 3.02.

|

WTI |

9.35% |

|

Brent |

5.77% |

|

Natural Gas |

-4.81% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?