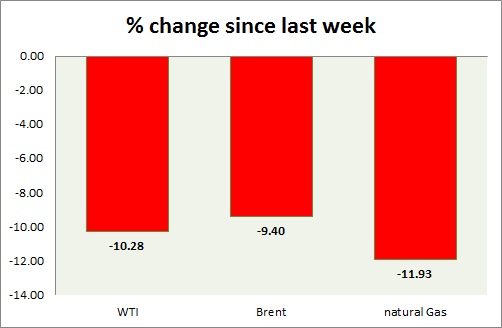

Energy pack is red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is back falling as glut concern came back to focus. Today's range $30.1-31.5

- WTI is currently trading at $30.2/barrel. Immediate support lies at $28, area and resistance at $32, $34, $39 area.

Oil (Brent) -

- Brent is relatively better performer than WTI this week. Today's range - $32.3-34.2

- Brent is at $2.3/barrel premium to WTI.

- Brent is trading at $32.5/barrel. Immediate support lies at $25, $29 area and resistance at $35, $39 region.

Natural Gas -

- Natural gas wiping out last few weeks' gains as winter season in retreat. Today's range $2.02-2.15

- Active call - Buy Natural gas @2.2 and at dips with target around $3.72 and stop loss at 1.68

- Natural Gas is currently trading at $2.03/mmbtu. Immediate support lies at $2 area & resistance at $2.2, 2.32

|

WTI |

-10.28% |

|

Brent |

-9.40% |

|

Natural Gas |

-11.93% |

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022