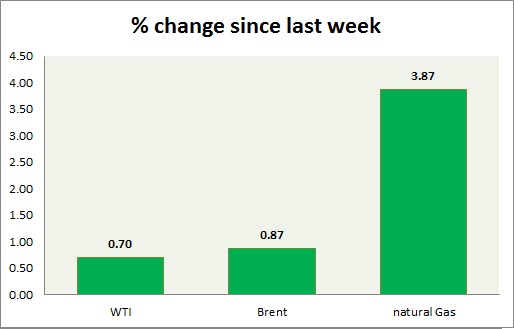

Energy pack is up in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil price remains elevated despite higher supplies from OPEC, Russia and the United States as inventory declines and Iran sanctions weigh. Saudi Arabia has announced that they are comfortable with the current level of production. However, sharply down since last week as investors shun risk assets. Today’s range - $71.2- $72.7

- WTI is currently trading at $71.8/barrel. Immediate support lies at $68 area and resistance at $75 area.

Oil (Brent) –

- Brent remains elevated over WTI due to higher demand, geopolitical tension and OPEC agreement. The recent disappearance of a Washington Post journalist at Saudi Consulate has triggered an international backlash and the market is pushing prices higher on fear of sanctions on Saudi Arabia. Today’s range - $80.5-81.9

- Brent is trading at $9.3 per barrel premium to WTI.

- Brent is trading at $81.1/barrel. Immediate support lies at $78 area and resistance at $85 region.

Natural Gas –

- The natural gas price has cleared sellers around $3.10 area. The lower level of inventory is providing support, along with hurricane Michael. Next target $3.47 per MMBtu. Today’s range $3.15-$3.28

- Natural Gas is currently trading at $3.26/MMBtu. Immediate support lies at $3.10 area & resistance at $3.47

|

WTI |

+0.70% |

|

Brent |

+0.87% |

|

Natural Gas |

+3.87% |

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022