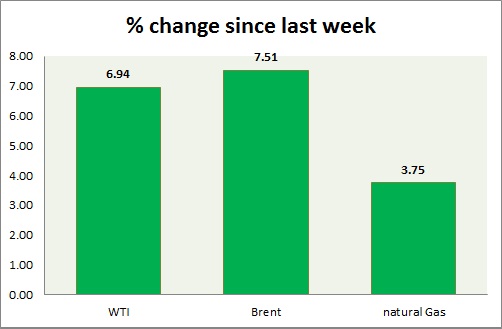

Big selloffs continuing in energy segment after last week's big fall. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI selloffs accelerated and price moved very close to target. WTI is yet to reach initial target of $42/ barrel, so further selloffs expected. WTI is currently trading at $43.4/ barrel, down nearly 3% today. Immediate support lies at 42 and resistance at 45.

- Oil (Brent) - Brent continued its fall in today's trading and failed over the spreads too. Brent-WTI spread is trading at $ 9.8, support lies at $8 and resistance at $13. Brent has reached its initial target around $ 53/barrel is likely to move in consolidation ahead of FED meeting though momentum might take the pair lower towards next support. Brent is trading at $53.4/barrel. Immediate support lies at 53.2, 52.4 & resistance at 54.8.

- Natural Gas - Natural gas still looking for direction as summer months approach. Price is consolidating in tight range, there might be breakout ahead. Immediate support lies at 2.65 & resistance at 2.93.

|

WTI |

-3.32% |

|

Brent |

-1.80% |

|

Natural Gas |

-0.81% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand