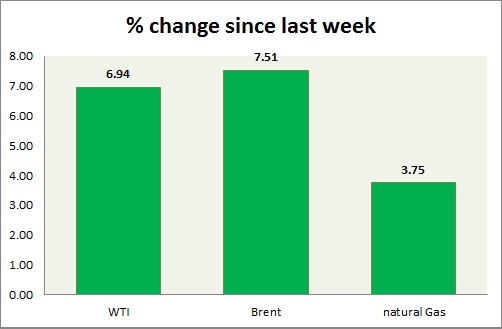

Sellers continue to appear at rallies in energy segment. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI failed to gain traction over weaker dollar as selling pressure reappeared at rallies and may lose further ground as key support got broken. Selloffs might push the price as low as $42/barrel. WTI is currently trading at $47.5/ barrel. Immediate support lies at 47, 42 and resistance at 49.2.

- Oil (Brent) - Brent remained concern over supplies, however recovered further grounds especially against spreads in today's trading. Brent-WTI spread is trading at $ 9.7, after reaching below $8 this week. Monday it traded around $13. Price pattern suggests a move towards $ 53/barrel is likely as key support at 58 was broken. However prices might test 60 levels before any fall. Brent is trading at $57.2/barrel. Immediate support lies at 53.2 & resistance at 60.

- Natural Gas - EIA reported inventory fell by 198 billion cubic feet, more than expectation but Natural gas, failed to gain much as inventory fall is still lower than previous week's 228 billion cubic feet. Natural Gas is currently trading at 2.80/mmbtu. Price range is squeezing, there might be breakout ahead. Immediate support lies at 2.65 & resistance at 2.87.

|

WTI |

-4.65% |

|

Brent |

-4.11% |

|

Natural Gas |

-1.41% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand