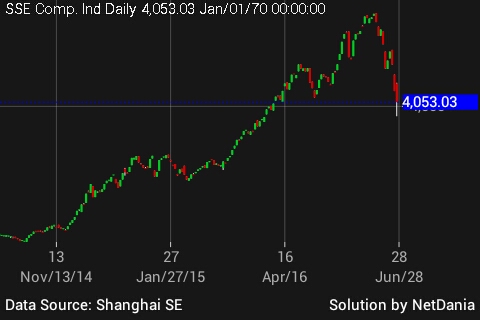

Chinese economy and the stock market, both having worst time since 2008 crisis.

Today Chinese services PMI dropped to 51.8 in June, which is worst since February this year. While services PMI is still on expansionary territory, manufacturing remains in contraction for many months now.

Chinese benchmark stock index dropped by -5.77% today. Within a month Chinese benchmark CSI 300 has dropped almost 29% after gaining more than 150% since last June.

The impact of this fall could be heavily felt since huge speculative bets and margin lending make retail customers extremely vulnerable to loss.

This week stands as fourth worst week in a decade. Index have plunged 12.1% this week. Among the other three, one was last month when index dropped -13.32% and other two was during 2008 financial crisis.

China's another benchmark, Shenzhen index dropped -16.16% to close the week, which is worst since 1996 when the index had dropped -28.5%.

Volatility has also reached extreme levels. 5 day average of realized volatility has reached 7.3%.

People bank of China (PBOC) tried rate cut, reserve ratio cut last weekend, as of now it seems they are not enough.

Regulators have also tried to halt the rally by relaxing collateral rules on margin loans and launched probe into short selling and market manipulation, all of which seems to have failed so far to calm investors.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary