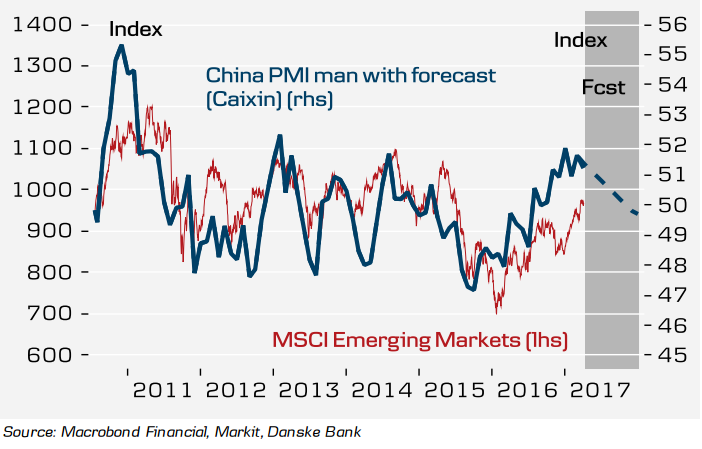

A range of leading indicators for China are sending a clear negative signal for economic growth in H2 2017. Chinese authorities have embarked on tightening and policy boost is likely to fade. The impact from tightening will start to feed through soon. A loss of upward momentum is generally associated with a sign of a peak in the cycle and thus points to slowing growth ahead.

Chinese official PMI manufacturing report showed that the economy remained strong in March. Chinese official PMI manufacturing surprised on the upside, rising to 51.8 (consensus 51.7, previous 51.6). However, analysts feel the improving indicators are the consequence of another enormous splurge of credit. Strength of the housing market at the start of 2017 is likely to have postponed a slowdown.

Chinese growth continued to be strong throughout Q1, but leading indicators point to a slowdown in 2017, said Danske Bank. Over the course of the last twelve months, trade figures deteriorated month after month almost. The IMF has relentlessly extended warnings on debt levels and still monumental overcapacity across the entire economy. The government faces a challenging effort of prioritizing growth over balanced development. As PBOC embarks on further tightening, and investment plans are lower than in 2016, a slowdown looks imminent.

Chinese authorities are likely to concentrate more on de-leveraging and bearing down on overcapacity in the old industrial sectors as consumer demand lifts and new, higher value-chain economic activity expands. The People’s Bank of China (PBoC) is likely to continue on further tightening measures to cool the housing market.

"We continue to look for a peak in Q1 and a moderate slowdown during 2017. As a result China will contribute to a peak in the global business cycle in H1 and provide less support to Emerging Markets and commodity markets. The underlying downward pressure on CNY persists," said Danske Bank in a report.

USD/CNY was trading largely unchanged at 6.8831. FxWirePro's Hourly USD Spot Index was at 106.297 (Bullish), while Hourly CNY Spot Index was at -110.786 (Bearish) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy