Volatile trading in mainland Chinese equity markets, policy risk given no pre-set schedule for decisions, and macro releases that themselves may influence policy risks will all potentially have China contributing to the global market tone next week.

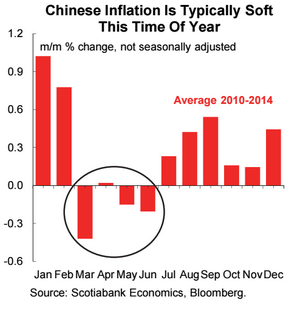

Chinese CPI inflation will be released in June and the debate is whether China is facing deflation risks. So far there is zero support for deflation arguments in the hard data. Only one CPI category - transportation and communication - has been experiencing falling year-ago prices. Falling monthly CPI is often misinterpreted because it is not seasonally adjusted and typically does decline in March through June with monthly price pressures more skewed toward the July-August time period and December through to February.

China might also release company financing figures. They'll be a reminder of how tiny equity financing is for Chinese firms (about 5% of aggregate financing) with most funding needs met through local currency loans and bond markets. This point is often lost in the discussion on Chinese equity markets. China's capital markets are still overwhelmingly skewed toward debt and with that goes underutilization of equity within firms' capital structures relative to most more developed capital markets.

Chinese Deflation Fears Exaggerated

Thursday, July 2, 2015 10:45 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022