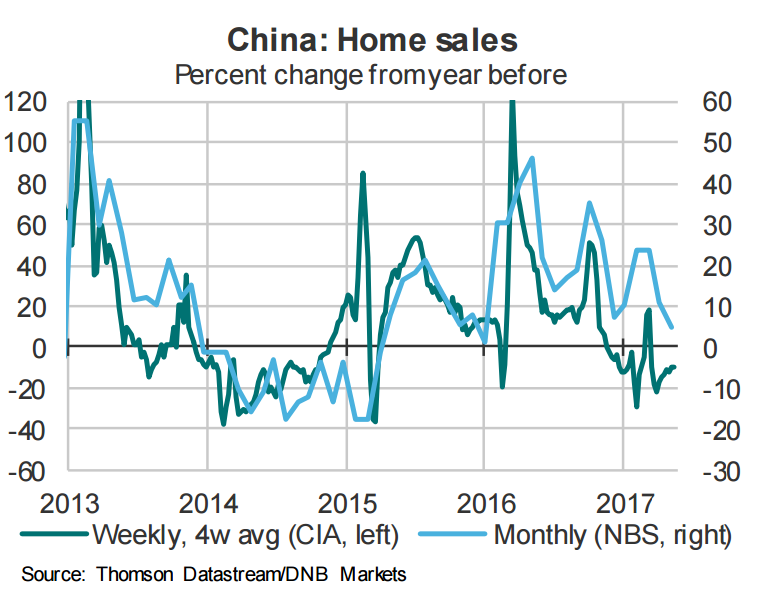

Latest data released by China Index Academy showed that a total 51,000 units were reported as sold for 30 T1 and T2 for week 20, down from 59,000 units in the corresponding week last year. China's home sales declined 13 percent y/y, consistent with that seen earlier this year. China's home sales till date this year stood at 945,000 units, down from 1,057,000 units in the same period last year, down 10.5 percent y/y.

Tough regulations imposed by Chinese regulators with restrictions on home purchases to prevent speculation in the housing market have seems to be working. That said, regional divergences seem to be rising. Sales in north-western cities rose by around 25 percent y/y, while sales in southeastern cities are fell by around 25 percent y/y.

Despite the decline in home sales, the rate of decline seems to be stabilizing around -10 percent. Due to large differences between regions, it seems likely that regulation will become stricter on a broader basis. The upshot is that analysts expect national sales growth to still likely to head into negative territory relatively soon, which should lead way for a moderate slowdown in housing starts in H2 this year.

"Monetary policy should be tightened further. We expect a couple of more hikes in the PBoC 7d repo rate this year," said DNB Markets in a report to clients.

Data released on Wednesday showed that growth in activity at China’s manufacturers was unchanged in May, with the official PMI remaining at the lowest level since September (51.2), but defying expectations of a drop to 51.0. The non-manufacturing PMI rose from 54 to 54.5. Meanwhile, the commodity price, led by iron ore, remained generally soft, suggesting that the investment growth is likely to moderate in the next couple of quarters.

While the PMI seems to point to some sort of stability, the activity indicators in April had already illustrated significantly slowing momentum. China needs to strike a balance between growth, debt and leveraging. The rising debt is the major concern for the economy, which also triggered Moody's downgrade on China recently.

"The deleveraging will continue to dominate the policy stance at this conjunction; therefore overall liquidity conditions will remain tight in both onshore CNY and offshore CNH markets," said Commerzbank in a report.

Chinese yuan strengthened on robust manufacturing PMI data. USD/CNY made intraday high at 6.8526 and low at 6.8169 levels. PBOC set yuan mid-point at 6.8633/ dlr vs last close 6.8525. A close below 6.85 will drag the pair lower. We prefer to take short position in USD/CNY around 6.85, stop loss 6.8710 and target of 6.8090.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns