Economics and government policies continue to have a big impact on demand in various commodity markets across China. China’s recent release of production data showed that output of steel, copper, and aluminium rose strongly in August. Higher margins and prices for these commodities appear to be the reason behind the uplift.

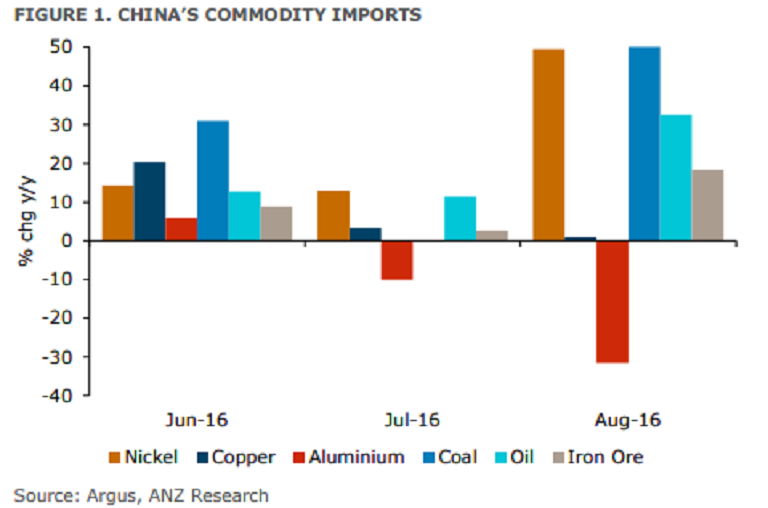

However, on the flip side, relatively low prices continue to put domestic crude oil production under pressure, while government policies around that reduce overcapacity has seen coal output continue to fall. This has then played out in China’s import demand. Copper and aluminium imports were weaker in August, while demand for nickel, coal, iron ore and crude oil remain strong.

Falling output in commodities such as copper and aluminium have seen import demand weaken in August. However, significant falls in production of crude oil and iron ore have continued to support apparent demand for those commodities. Further, a slew of production data from various commodities released over the past week suggests higher prices are inducing more supply back into the market, ANZ reported.

The International Aluminium Institute (IAI) released its estimate of global aluminium output for August this week, which fell 0.2 percent y/y. But the estimate of Chinese production climbed 2 percent m/m, while daily output rose to 87,500 tonnes.

Further, crude oil production fell 9.5 percent y/y in August, which continues a trend that started early this year. August output fell to 3.8mb/d, the lowest daily average since October 2011. Both Sinopec and PetroChina, China’s two largest producers, reduced their 2016 production guidance as a result of the closures of uneconomic fields.

"We will continue to see China use underutilised refinery capacity by importing more raw materials, such as crude oil, iron ore, and copper concentrates," ANZ commented in its latest research report.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX