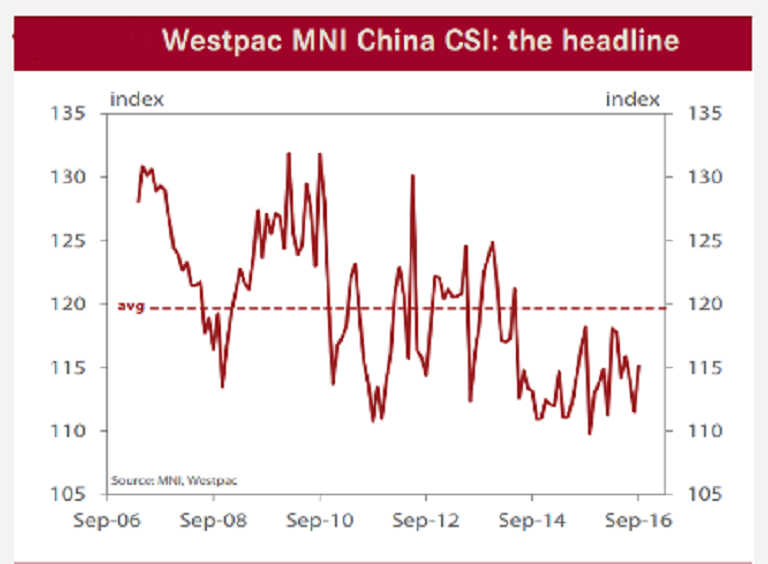

China’s consumer sentiment recovered during the month of September, although remaining well below the long-run average of 120, but is slightly above the average read over the last 12 months.

The Westpac MNI China Consumer Sentiment Indicator recovered in September, rising 3.3 percent to 115.2 from 111.5 in August. All five components improved in September. Consumers’ near-term expectations recorded the strongest gains: ‘family finances next 12 months up 7.1 percent and ‘business conditions, next 12mths’ up 4.9 percent.

Further, assessments of ‘business conditions, next 5 years’ recorded a milder 2.6 percent rise with views on ‘family finances vs a year ago’ up 1.3 percent and assessments of ‘time to buy a major item’ up just 0.7 percent. Notably, all components remain materially below their long-run averages.

Chinese consumers also marked up their assessment of current business conditions: the ‘business conditions vs a year ago’ index up 4.6 percent and basically in line with long-run average. Job security recorded a particularly strong rebound, the employment indicator surging 8.0 percent more than reversing last month’s 7.4 percent drop.

Meanwhile, this month’s rebound in confidence is clearly a welcome development, particularly after the sharp slide in June-August. However, even with a recovery, sentiment is still at a low level overall and yet to establish a convincing recovery.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient