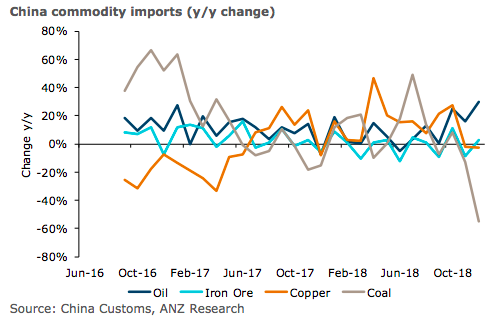

China’s commodity imports were mixed in December. Metals imports ended the year on a weak note, with copper down on a y/y basis. At the same time, imports of oil and natural gas remained strong. This suggests consumers remained cautious as trade tension rose in H2 2018.

"We expect this could turn around if talks ease the uncertainty, resulting in restocking of inventories in early 2019," ANZ Research reported.

Crude oil imports in December rose strongly, as refiners took advantage of higher refining margins amid a rush to utilise quotas before year end. Import volumes reached a record high of 43.8mt, bringing the annual growth rate to 10.1 percent. China’s ‘blue sky’ policy benefitted natural gas, with imports up 68 percent in 2018.

The ban on coal imports at certain ports resulted in volumes collapsing in December. However, with the ban being lifted in January, this weakness persisting for too long. Iron ore imports rose slightly in December (+3 percent y/y), matching anecdotal evidence suggesting steel mills in China are starting to restock ahead of the end of winter production curbs.

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns