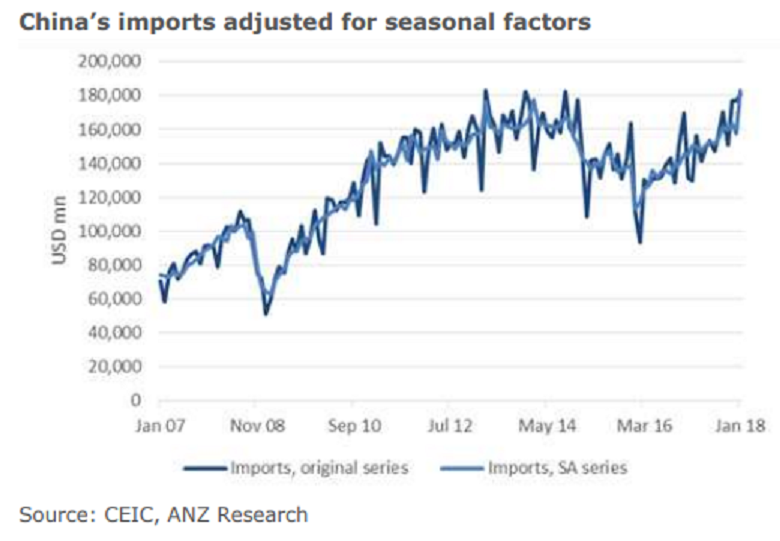

China’s booming imports are expected to conceal the near-term volatility, according to a recent report from ANZ Research. Seasonality, cold weather and higher commodity imports pushed up import growth in January. The timing of the Lunar New Year, which falls on different dates, and sometimes months, each year partly explains the surge in imports in January. After adjusting for seasonal factors, actual import growth is lower by around 10ppts.

At the same time, commodity imports rebounded in January, led by crude oil (up 19.6 percent y/y), coal (up 11.5 percent y/y), and iron ore (up 9.3 percent y/y) in volume against a colder winter. Higher commodity prices, especially imported oil prices which rose 13.8 percent y/y also account for the rise in commodity imports. Another big ticket item behind the boost in imports were mechanical and electrical products, which spiked more than 40 percent y/y, contributing more than half of the headline import growth.

The stronger-than-expected export growth suggests a continuous recovery in global demand. Exports to major markets including the US, EU, and ASEAN grew by 12.7 percent y/y, and 11.6 percent y/y and 20.5 percent y/y, respectively, which are in line with our view of recovering global demand. However, given the seasonal pattern surrounding the Lunar New Year, we may see more volatilities emerging in February and March.

"The uncertainty surrounding Sino-US trade ties remains a key potential downside risk in the near term. Despite a drop in the China-US trade surplus in January (to USD22 billion from USD26 billion prior), China’s near-term trade outlook might still be clouded by the escalation in tensions between the two countries," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations