The contribution of the financial service sector should have dropped notably, following the equity market crash. The strength of the non-financial service sector will then be particularly critical, particularly to the labour market.

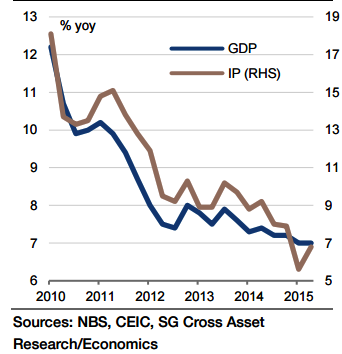

Judging from the IP data over the quarter, a limited improvement is expected in the industrial output. Construction was partly dragged down by further deceleration of housing activities but also partly propped up by infrastructure build-out.

"China's Q3 real GDP growth is likely to be little changed again. A 0.1pp dip is expected in the headline rate from 7% yoy in Q2 (and Q1) to 6.9% yoy. However, the nominal data and the sector breakdowns are worth paying more attention to", says Societe Generale.

As for September activity data, IP growth probably remained lacklustre due to a negative base effect and fewer working days yoy. However, fixed asset investment growth might have improved to 11% yoy from the record low of 9.2% yoy in August.

"Housing investment growth probably did not get any worse, while infrastructure investment stepped up amid strong lending support. Also the retail sales are expected to accelerate modestly, taking their cue from robust tourism and iPhone sales", added Societe Generale.

China's Q3 GDP is likely to be little changed

Monday, October 19, 2015 5:11 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed