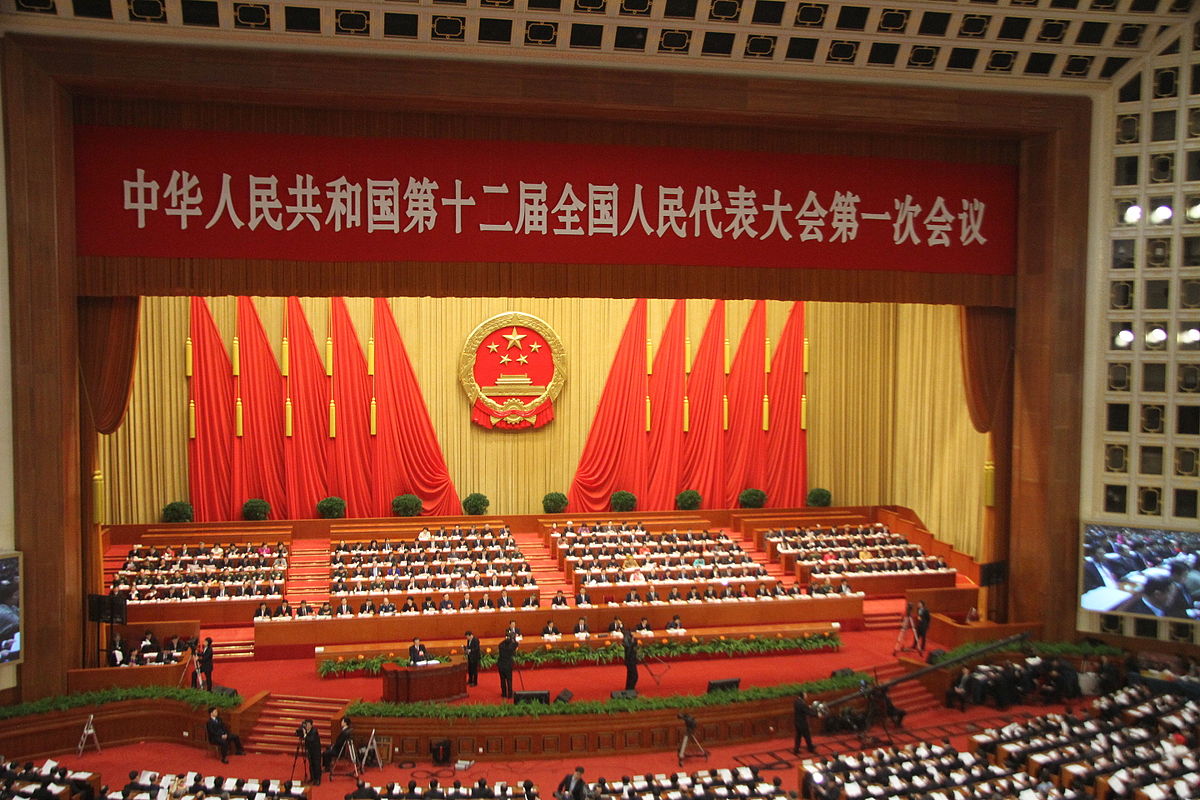

China's National People's Congress has cut 2016 economic growth target to 6.5-7% from 7% in 2015, on par with expectations. The government's promise to increase China's GDP per capita by two-fold by 2020 with average growth of 6.5% in the 13th Five-Year Plan (2016-2020) and continuous downward pressure on economic growth led the government to cut the GDP growth target.

According to Government Work Report (GWR), by setting that target range, it will help steady and guide market expectations. Also, the 6.5-7% growth will ensure enough employment. The government has kept the target for new urban job creation above 10 million, as compared with actual job creation of 13 million in 2015.

In line with Governor Zhou's recent comment on a "moderately loose" policy stance, "prudent" monetary policy is expected to be "flexible and appropriate". For 2016, the Chinese government set the M2 growth target at 13%, as compared with 2015's 12%, indicating accommodative monetary policy. The consumer price index inflation target was kept unchanged at 3% for 2016, in spite of actual inflation of 1.4% in 2015. This implies certain perceived uncertainty associated with developments in commodity prices and energy in 2016, and the People's Bank of China's preference to keep room for easing.

"We continue to look for more RRR cuts (100bp in total) and two benchmark interest rate cut of 50bp in 2016", says Barclays.

Meanwhile, the Chinese government has raised the budget deficit target to 3% of GDP from 2015's 2.3% of GDP. However, it is expected that the actual deficit might rise to 3.5-4% in 2016 from 3.5%. According to GWR, 2016 general budget deficit will be raised to 3% of GDP. Furthermore, it highlights plans to further increase public investment. It mentioned that the government will raise budgeted central government investment spending to CNY500bn and set up additional new projects.

Also, the National Development and Reform Commission (NDRC) stated that it plans to attain FAI growth of around 10.5% in 2016, slightly more than the actual growth of 10% in 2015. Meanwhile, NDRC forecasts nominal retail sales to grow 11% this year, as compared with the 2015's actual growth of 10.7%.

Meanwhile, the 2016 GWR underlined supply-side reforms as a focus for structural adjustment and reforms. The Chinese government intends to boost effective supply and potential growth. Mainly, capacity reduction will be carried out in many energy and manufacturing sectors, such as cement, coal and iron and steel. According to the government, credit and social policies will support these in order to speed up the exit of uncompetitive companies while containing social costs of unemployment.

"Production cuts and industry consolidation should help to stabilize resource prices (as we have seen in recent weeks in the coal, steel, and cement sectors) and boost industry profits, in our view", says Barclays.

China lowers 2016 economic growth target range, highlights supply side reforms for structural adjustments

Monday, March 7, 2016 11:30 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022