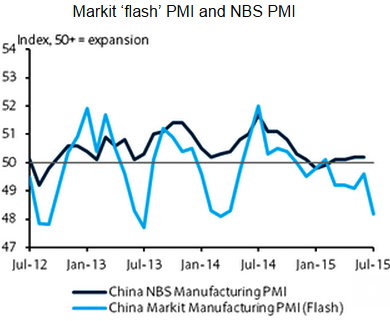

The headline PMI deteriorated from its final reading of 49.4 in June, with the output sub-index worsening to 47.3, a 16-month low. The Markit "flash" manufacturing PMI fell to 48.2 in July, reaching a 15-month low, where consensus was expecting to fall 49.7. The new orders sub-index fell to 48.1 from 50.3 in June, accompanied by soft new export orders. The decline in the output prices and input prices sub-indexes accelerated, a trend that is likely to continue to exacerbate PPI deflation and weigh on manufacturing activity, expects Barclays. The employment conditions component remained soft, reflecting corporates' muted expectations for demand conditions both at home and abroad, although it declined at a slower rate in July.

"The weaker PMI supports our view that the economy is not on solid footing, and we look for a flat growth profile in H2. We maintain our 2015 growth forecast at 6.8%, which assumes stabilising property investment and solid infrastructure investment in H2. The risks to our outlook are tilted to the downside, despite improving macro data in June", estimates Barclays.

Electricity consumption, auto sales and company-level evidence suggest growth has remained soft. The leverage-driven equity boom-bust has hurt sentiment and poses downside risks to growth. Falling commodity prices are also likely to discourage restocking and investment. With the government appearing comfortable about the labour market situation in Q2, the flat sequential growth momentum is expected to be at 7.0% q/q saar in Q3 and 6.6% in Q4, from 7% in Q2, said Barclays in a report on Friday.

Due to weaker PMI China likely to grow at 6.8% in 2015

Friday, July 24, 2015 4:55 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX