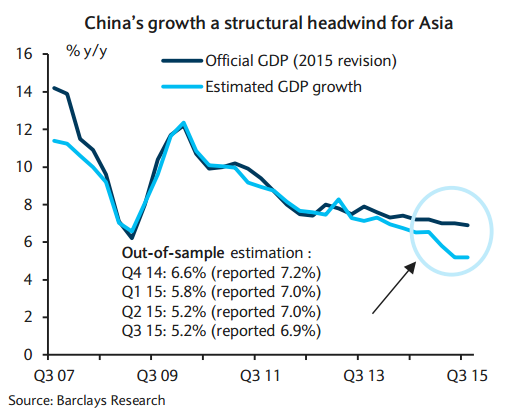

Beijing has rolled out a raft of support steps to avert hard landing in the economy, including cutting interest rates six times in the past year, but the stimulus has been slower to take effect. Data earlier in the month showed that China's manufacturing industry unexpectedly contracted for a third straight month, missing market hopes for a break-even 50.0 reading. The world's second-largest economy grew 6.9 percent in the third quarter from a year earlier, the weakest pace since the global financial crisis. However, the latest economic indicators in general point to a continued deterioration in real activity, in sharp contrast to the flat sequential growth momentum suggested by the official Q3 GDP print of 6.9%.

However, there are a few emerging positive signs, with property sales and prices appearing to be on an uptrend, and household loans for housing have improved slightly as well. The PBoC along with cutting the policy rate 125bp through 2015, has also eased macro prudential measures to ease the housing glut and slump in building activity. Retail sales growth has also been holding up, with online retail growth remaining especially robust. Chinese President Xi Jinping told G20 leaders meeting in Turkey on Sunday that China was able to keep up medium to high economic growth and expects this year's growth to be around 7 percent, which would nevertheless be the weakest in a quarter of a century. Analysts expect more monetary policy easing from PBoC in H1 16 (taking the RRR and benchmark rate 50bp lower).

India and Indonesia are showing more signs of promise. In India, the RBI has delivered 125bp of cumulative policy easing, which is helping reduce debt servicing costs and improving retail loan demand. The underlying activity has been improving at a faster pace, with private consumption and public investment leading the pick-up amid declining inflation. In recent months, there has been a broadening in sectors that are doing better, and the buoyancy of domestic activity is illustrated in improving car sales, rising aviation traffic, and improving consumer goods production.

In Indonesia, after the cabinet reshuffle in August, the pace of implementation of public investment projects has improved, helped by better coordination among government agencies. Although Q3 growth was still slow, we expect public spending to be the key growth driver in Q4. A decline in inflation to a one-year low and economic growth trailing estimates would typically spur Indonesia's central bank to cut interest rates. Indonesian business associations and government officials have repeatedly called for a rate cut to stimulate the economy. But BI Governor Agus Martowardojo said earlier today that the c.bank will be cautious in easing monetary policy. As inflation also rolls down, Bank Indonesia could start easing monetary policy - from November - and into 2016.

While noting that the monetary review will be a close call, Barclays analysts Wai Ho Leong and Angela Hsieh expect BI to announce a 25-basis-point rate cut this month due to the "rolling down of the inflation trajectory, coupled with better external balance."

China, India and Indonesia plan extra monetary stimulus in 2016

Tuesday, November 17, 2015 11:53 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary