The August Caixin manufacturing PMI fell to 47.3 the lowest since March 2009, stoking fresh investor fears of a hard economic landing. The 40% drop in the Shanghai composite since June has sparked a global market malaise.

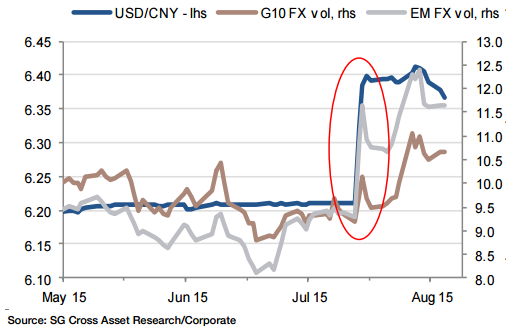

The PBoC devalued the CNY on 11 August and changed the FX regime (fixing now based on previous day USD/CNY close).

"After cutting interest rates and weakening the currency, will fiscal stimulus follow to keep growth on track of 7% this year? USD/CNY is targeted at 6.80 in Q4 15", estimates, Societe Generale.

The PBoC last month cut the RRR by 50bp to 18% and the lending and deposit rates by 25bp to 4.60% and 1.75% respectively. This will not be enough; further policy easing is required, adds SocGen.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX