The continued weakness in Chile's trade data shows that both the domestic economy and the external demand environment have yet to show any sign of revival.

As a result, and despite the fact that significant fiscal spending is underway, the economy in Q2 continued to grow significantly below its trend rate, that itself has declined by nearly 25% over the past couple of years.

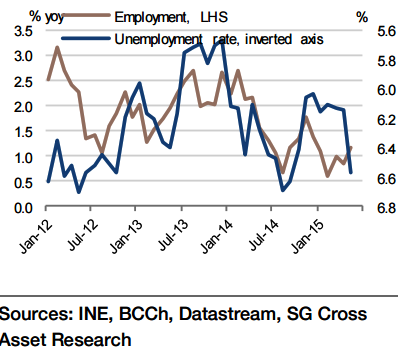

"The unemployment rate is expected to have risen one tick to 6.7% in June assuming a slightly lower pace of growth in both the labour force and employment. Both these indicators grew faster than their recent pace in May and we expect some moderation in June", says Societe Generale.

The developments in the labour market in the context of improving but still sub-trend growth have been quite remarkable.

A stronger labour market, a pre-condition for stronger consumption growth, will require a significant surge in investment activity. The labour market might have been improving on the back of significant public spending, and there remain considerable limitations to this strategy in themedium term.

Chile's unemployment rate likely increased in June

Monday, July 27, 2015 9:22 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX