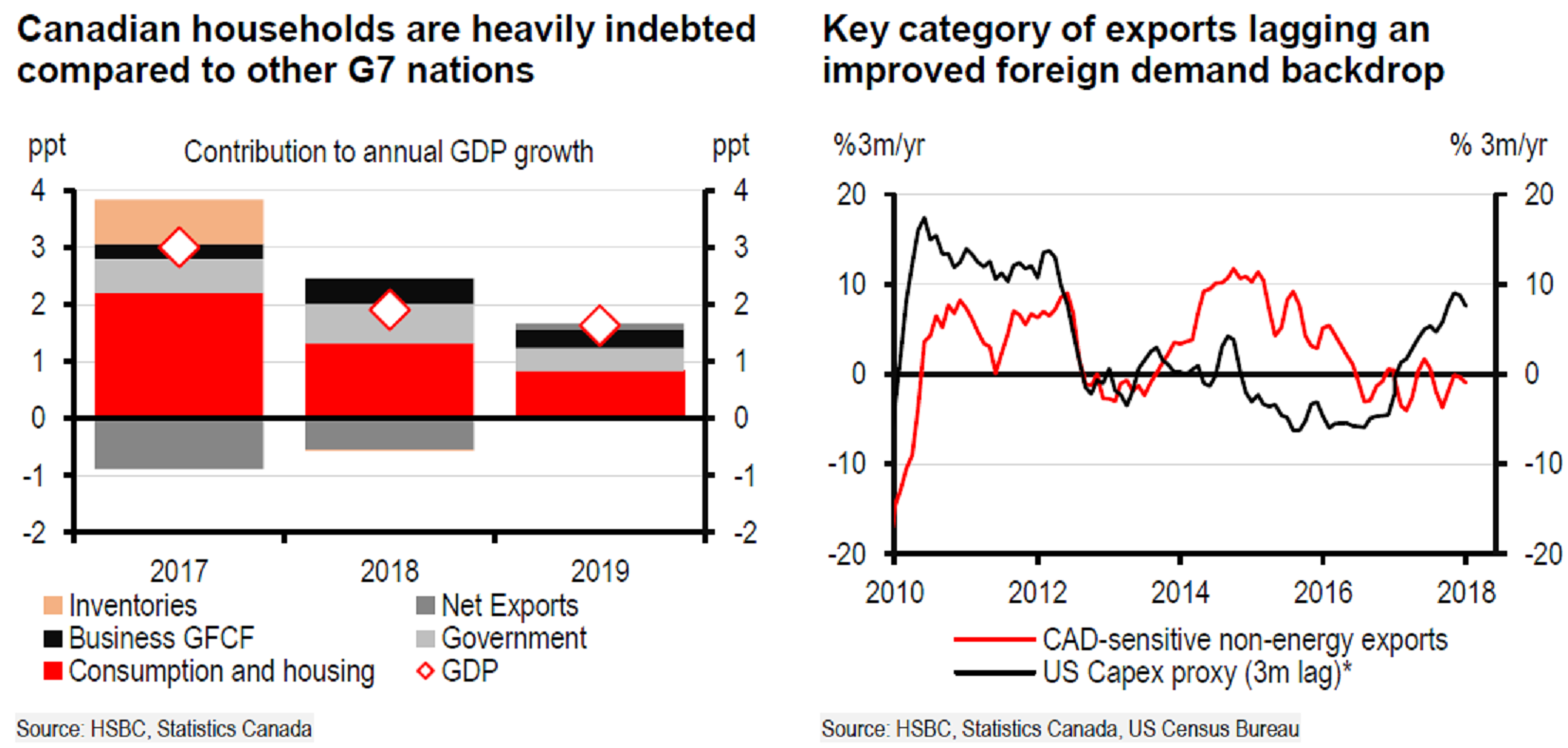

Canadian economic growth is expected to decline to 1.9 percent this year and 1.6 percent in the next year, according to a recent research report from HSBC Securities. From an average pace of 3.7 percent in the prior four quarters, GDP growth dropped to an average pace of just 1.6 percent per quarter in H2 2017.

The main factor leading to the growth slowdown in both 2018 and 2019 is moderation in the household sector, with slower growth in consumer spending and residential investment. In 2018, consumption growth is expected to decline to 2.4 percent from 3.5 percent in 2017. While employment and disposable income are considered supportive of consumption, a debt overhang is likely to weigh on households.

With the household sector stepping back, challenges still seem to remain in rebalancing the economy toward business investment and exports. Although business investment is expected to expand by 4.2 percent in 2018, up from 2.4 percent in 2017, a recent survey revealed that private sector capital expenditure intentions remain cautious.

Bank of Canada (BoC) Deputy Governor Tim Lane also recently noted that US trade policy uncertainty is affecting investment decisions and that recent US tax policy changes might “further reduce the relative attractiveness of investment in Canada”.

"We expect exports to rise by 1.1 percent in 2018, up only slightly from last year (previous forecast 1.3 percent). On the positive side, improving US capital expenditure represents a better backdrop for foreign demand, and Canada has been temporarily exempted from US tariffs on imported steel and aluminum," the report said.

However, currency-sensitive non-energy exports have stalled despite the improving external demand, and a number of potential headwinds are gathering. Most notably the fate of NAFTA remains unclear, and Canada been featured prominently in US trade investigations and actions on softwood lumber, aerospace, newsprint, solar panels, and welded pipe.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions