Today Canada CPI would be released at 12:30 GMT.

Canadian dollar is currently trading at 1.226 against dollar, bounced back from support area around 1.217-1.213. Canadian dollar remains weak against USD, however recent downfall of the dollar has pushed the pair towards support.

After advancing against dollar with rise in oil price, USD/CAD found support near 1.19 from where stronger dollar and consolidating oil price have pushed the pair towards 1.25 against dollar. However again weakness in the pair has brought it towards support area of 1.21.

- The above movement indicate dollar as of now is guiding the movement in the pair.

- With oil price weak and Bank of Canada providing no further cues to monetary policy focus will turn towards economic dockets for Canadian dollar leg.

Today's CPI numbers either might provide strength required to Loonie, which would help it break the support around 1.21 or else it would raise bets of another cut by Bank of Canada (BOC).

Past trends -

- Headline consumer inflation has fallen from above 2% to 1% over the last year. However this is mostly due to lower energy prices. However with oil price somewhat bouncing back, headline inflation has been showing some signs of life back. In April headline inflation was 0.8% on yearly basis.

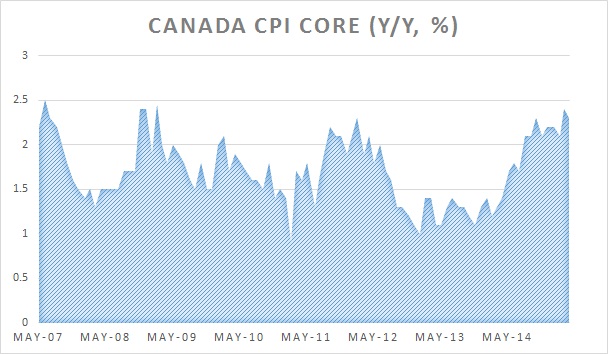

- However core inflation has remained steady in spite of recent drop in energy prices and rising steadily from 1% in 2013 to 2.3% as of April, 2015. It dropped by 0.1% from March.

Today, median estimate shows, softness in CPI expectation. Core inflation is expected to rise at 2.1% y/y in May from 2.3% in April.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings